Let’s be honest: travel insurance is probably the most mundane aspect of planning your holidays. What makes it even more confusing is knowing where to even start, as there are loads of travel insurance companies out there trying to convince you that their cover is the best.

However, some travel insurance companies do a great job of simplifying the process, either by tailoring their cover to specific types of travelers, or through tech forward user-friendly websites, which make navigating this complex world a lot easier.

Enter Heymondo, Safetywing, Genki and World Nomads, four of the most innovative upstart travel insurance providers. Here I cut through the corporate noise and put them all to the test using real-world travel scenarios and policy comparisons to help you make the best choice of travel insurance provider for your next trip. Let’s get into it…

Why do I know about travel insurance?

I’ve lived and worked in several different countries, I’m a long-term ex-pat, I did a round the world trip, and I even worked as a travel agent selling travel insurance! So, I’ve been a digital nomad juggling time zones, I was a backpacker chasing adrenaline highs, and I also run my own outdoor activities and tour company, so I understand travel insurance from all sides.

I’ve also made my fair share of insurance blunders, like assuming my policy covered a lost camcorder at the airport (it didn’t), or the countless times I stupidly traveled without cover. So suffice to say I know what I’m talking here!

WORLD NOMADS VS SAFETYWING VS GENKI VS HEYMONDO: THE BASICS

Let’s first introduce and give a little background into each of our four contenders, including their founding, some of their main policies, and what each is best known for…

Founded in 2017 by a bunch of vikings (Norwegians), SafetyWing is all about insurance that suits the modern, borderless lifestyle. Initially designed with digital nomads in mind, the company became popular for offering flexible, subscription-based policies that cater to long(er)-term travelers and remote workers. Unlike traditional insurance providers, they also operate globally, providing coverage in over 170 countries.

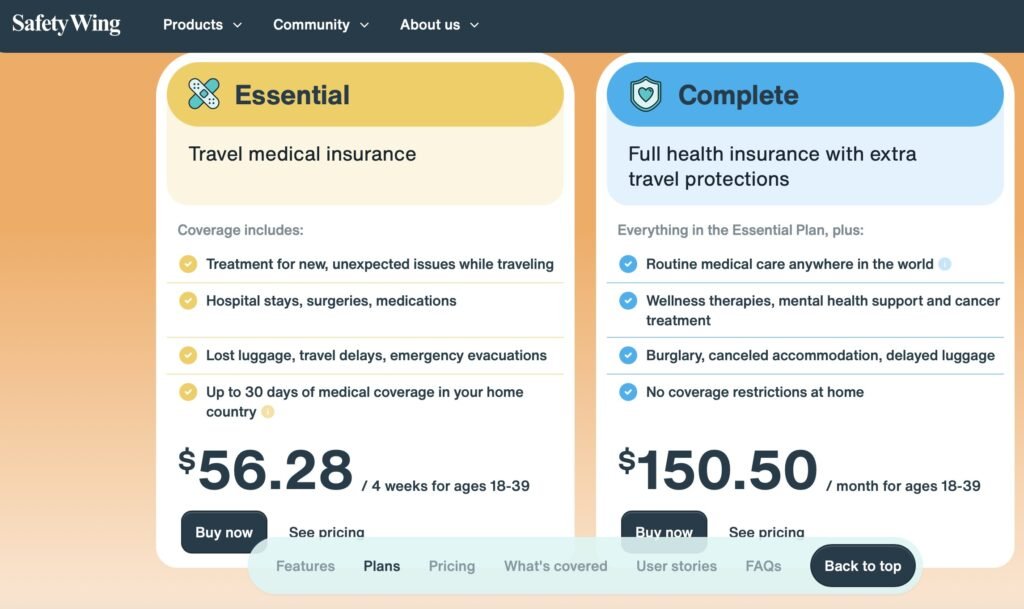

Safetywing offer two different levels of cover: 1) its Nomad Insurance Essential plan, which should be considered a global travel medical insurance for medical and travel related emergencies; and 2) its Nomad Insurance Complete plan, which is a much more comprehensive annual plan, including routine check ups, mental health, and maternity.

The main highlights of each policy are made clear all over their website, and they make it easy to add on additional protection for three commonly sought areas i.e. adventure sports, electronics theft, and stays in the USA.

Maximum age of travelers = 69 for Essential, 64 for Complete.

Pre-existing medical conditions coverage: Essential – No / Complete – Yes (if developed during a previous subscription period).

The elevator pitch: The lifestyle subscription model for long-term travelers and digital nomads.

World Nomads have been knocking around for a good while now, since 2002 in fact. Founded by two Aussie travelers for backpackers and thrill-seekers, the company quickly became a go-to for those exploring off-the-beaten-path destinations. Best known for its comprehensive coverage of over 200 adventure activities, World Nomads has built a rep for reliability and trust, and is backed by reputable insurers including Allianz.

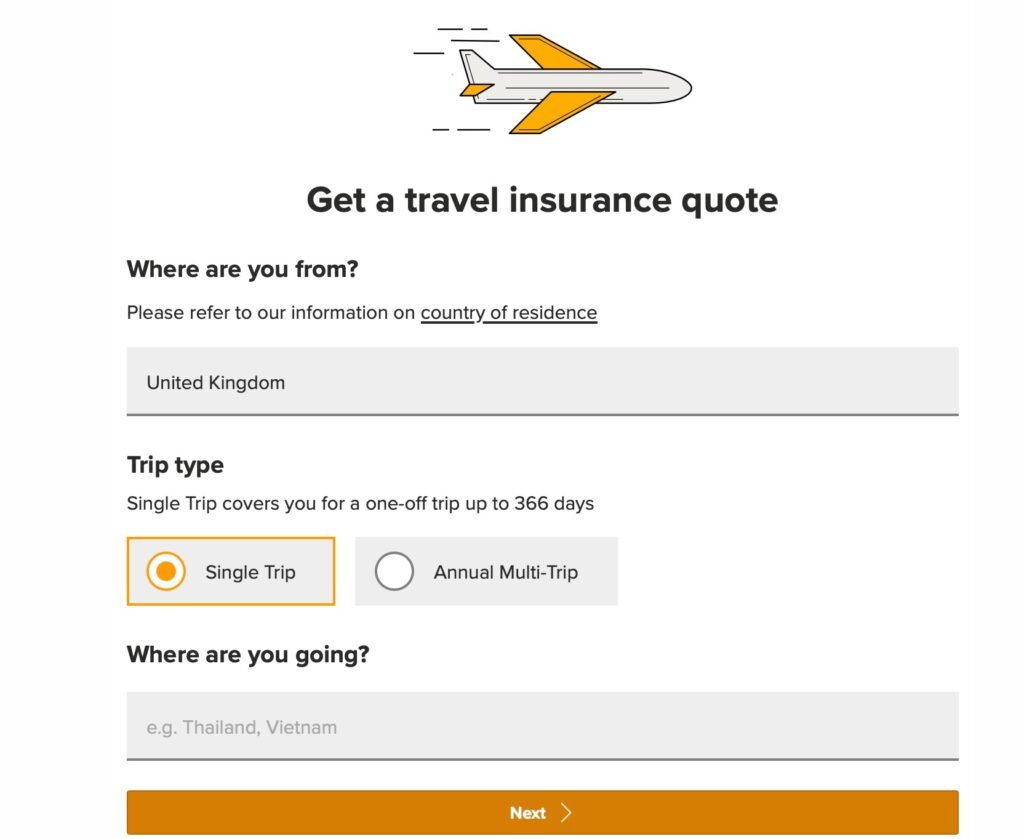

The company has different international versions of their website depending on where you reside. As such, they don’t highlight individual policy types on their front pages, as they offerings are so diverse. Rather, they display policy details only once you’ve input your country of residence, your destination country(s), your age, number of travelers, and your trip duration.

Maximum age of travelers = 70

Pre-existing medical conditions coverage: No

The elevator pitch: The adrenaline junkie’s best friend, ideal for intrepid backpackers and thrill-seekers alike.

Heymondo burst onto the travel insurance scene in 2018 with a tech-driven approach. Founded by a team of travel and insurance nerds, the company set out to simplify the often complicated world of travel insurance. With a sleek app, 24/7 customer support, and a focus on user experience, Heymondo is also backed by AXA insurance group.

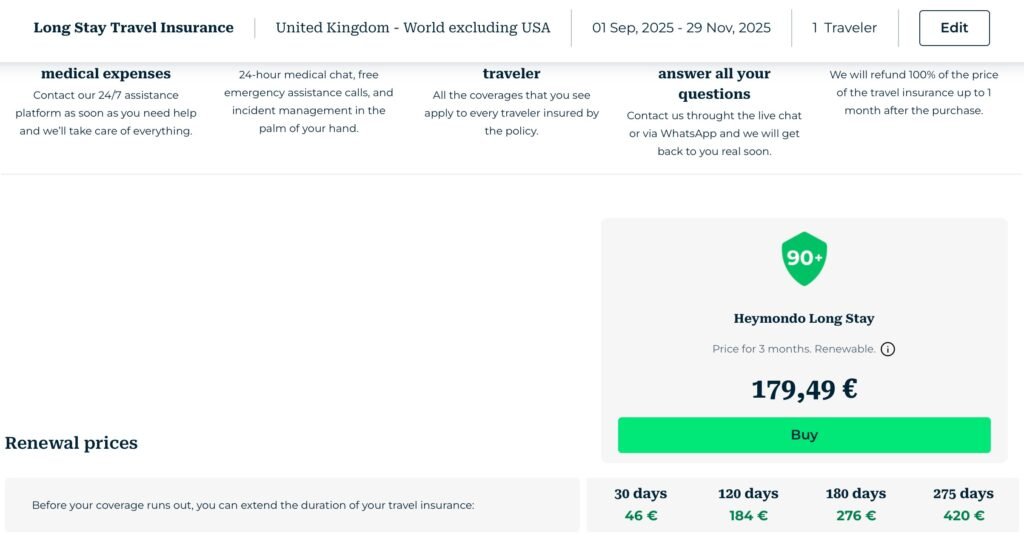

Heymondo keep things pretty simple by offering three different types of travel insurance: 1) International travel insurance, which tends to be most useful when seeking quotes for a single trip abroad; 2) Annual multi-trip travel insurance, which allows travelers to take an unlimited number trips of up to 60 days at a time within a 12 month period; and 3) Long-stay travel insurance, which insures you for an initial 90-day period, before giving you the option to then renew for various time periods (1, 3, 6 or 9 months). This is particularly useful if you’re planning a trip lasting over 90 days, but can’t say exactly when you’ll be back.

Make sure to input your travel details in the most appropriate section of the website i.e one of the three options above, otherwise you may be missing out on their best prices.

Age limits: 69 for short trips up to 29 days, 49 years old for trips over 30 days.

Pre-existing medical conditions: No.

The elevator pitch: The tech-forward, great value choice for every style of travel.

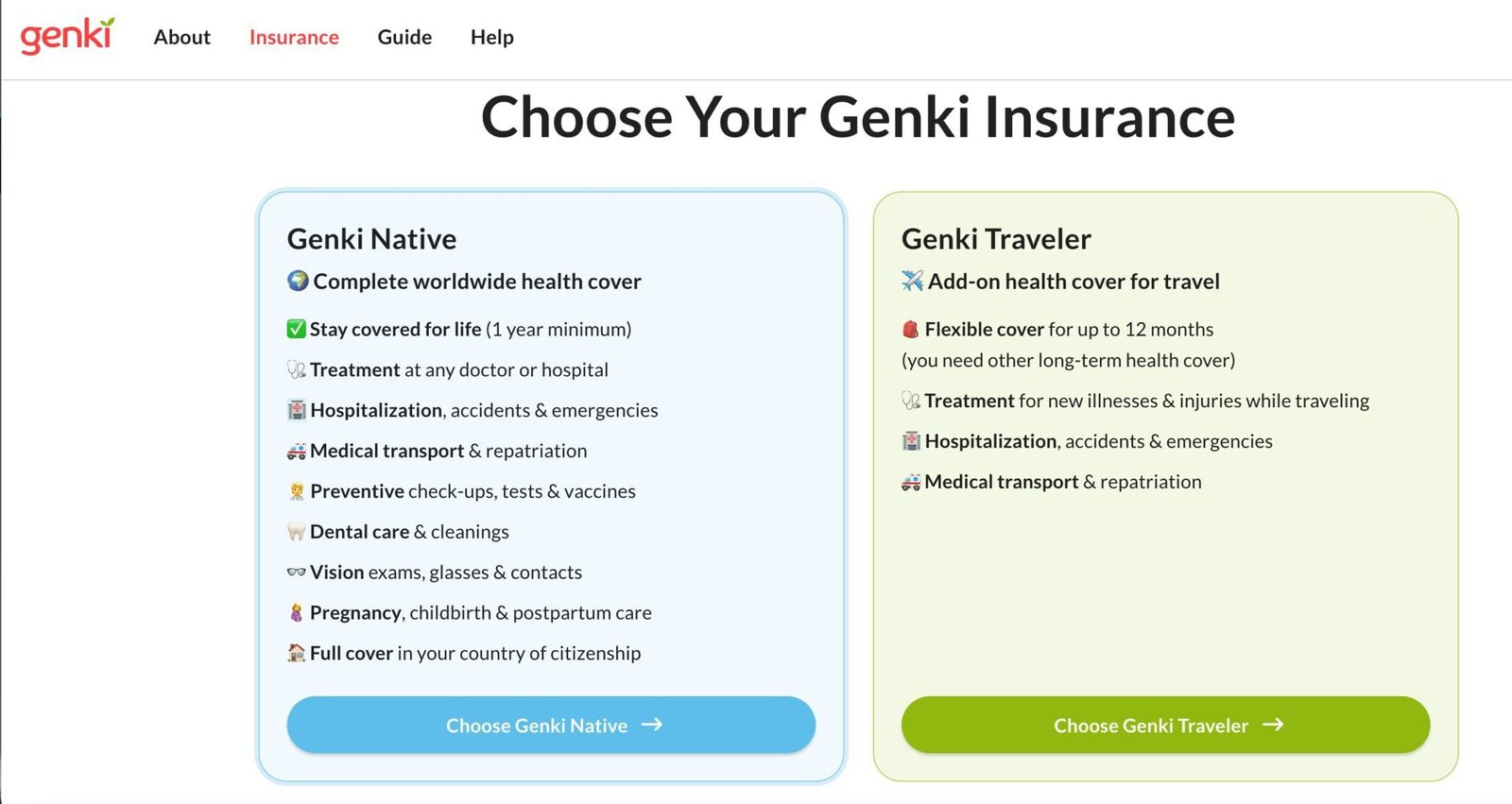

While World Nomads, SafetyWing, and Heymondo are often compared as travel insurance providers, Genki sits slightly outside the traditional category.

Rather than offering full trip protection (baggage, delays, cancellation), Genki focuses almost entirely on health insurance for travelers and digital nomads. This makes it an important fourth option to consider — especially for digital nomads and long-term travelers who care less about lost luggage and more about serious medical coverage.

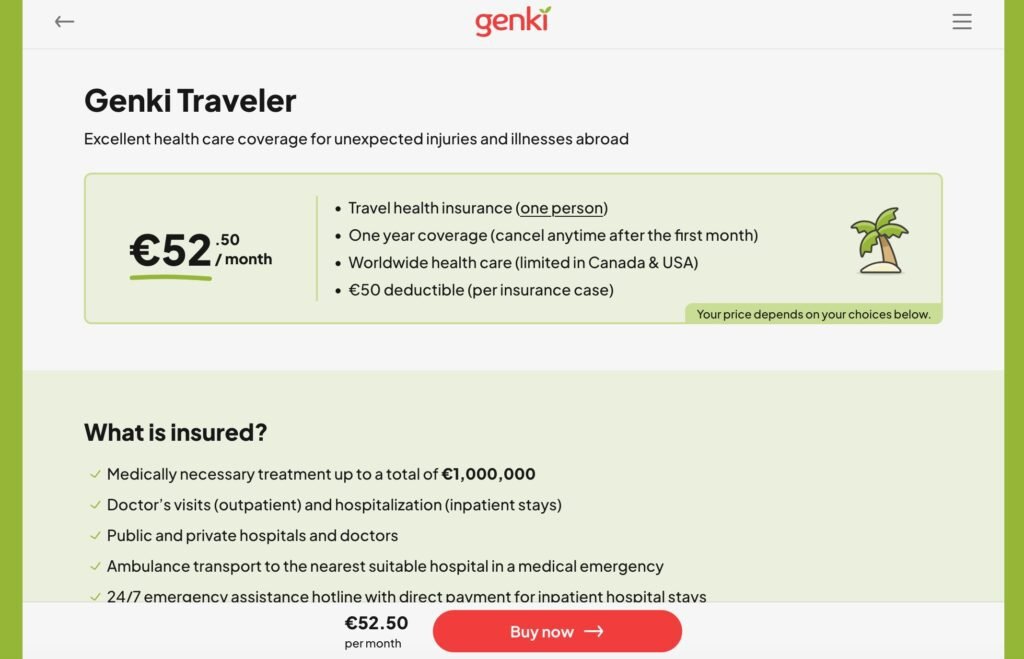

Genki was only founded back in 2018, making it the joint youngest of our contenders. Based in Europe, with headquarters in Germany, they offer two types of health insurance, Genki Traveler (flexible monthly subscription model) and Genki Native (1 year minimum term).

The company is regulated under European insurance laws, which provides a solid legal foundation and consumer protections.

Age limit = None!

Pre-existing medical conditions coverage: Genki Traveler – No / Genki Native – On review.

The elevator pitch: The long-term travel health insurance specialists.

COMPARING SAFETYWING, GENKI, WORLD NOMADS & HEYMONDO

Methodology

Anyone who’s searched online for travel insurance quotes before, will know that making direct comparisons using like-for-like plans isn’t really feasible here. This is because each company (apart from Safetywing) seems to categorize their offers differently depending on which country you’re from.

To most effectively put each of these three companies to the test, I’ve therefore decided use a few different real-world scenarios based on common trips made by international travelers, myself included.

Our intrepid world travelers...

-

Backpacker Dave - 6 months in South-east Asia

-

The Griswald family - 2 weeks in Italy

-

Pam & Barry - long-stay in the USA

Dave, a 24 year old British backpacker is visiting South-east Asia and Australia for 6 months. His dream is to go cage diving with Great White Sharks (the nutter), to get his PADI Scuba diving certification, and to do a skydive and bungee jump. He just wants to go with the flow as far as his money will take him. He’s in the prime of his life, so he’ll be partying it up and looking to save as much of his cash for beer as possible. Take it easy, Dave!

Our lovely family of four from Minnesota, the Griswald’s are looking forward to only their second ever trip to mainland Europe with their teenage kids. Mum, Dad and the kids want to document their historic European vacation, so will be taking with them all their gadgets (laptops, SLR cameras, etc.).

Ah look, Pam & Barry are a fairdinkum couple in their mid-thirties from Bendigo, Australia, looking to get out and see a bit of the world. They’ve just sold their house and ute, and they can both work remotely, so have decided to take a year’s sabbatical abroad. They mostly plan to spend time in the USA and Latin America.

I plugged into the websites of Safetywing, Genki, World Nomads, and Heymondo to get quotes for each of the above travel scenarios. Using all the information available to me, I selected the most appropriate insurance cover based firstly on the specific needs of each of my three test voyagers, and then on price. So let’s dive in to the results, starting with our young gunner, Dave…

TEST #1: COMPARING ADVENTURE SPORTS COVER

Quick recap on Dave’s insurance needs: Dave is young, adventurous but highly price conscious. His trip is exactly the same as I myself took a few many years ago, so I know exactly what his needs are, far more so than he himself does!

Must haves: Adventure sports coverage. Ideally: cheap…

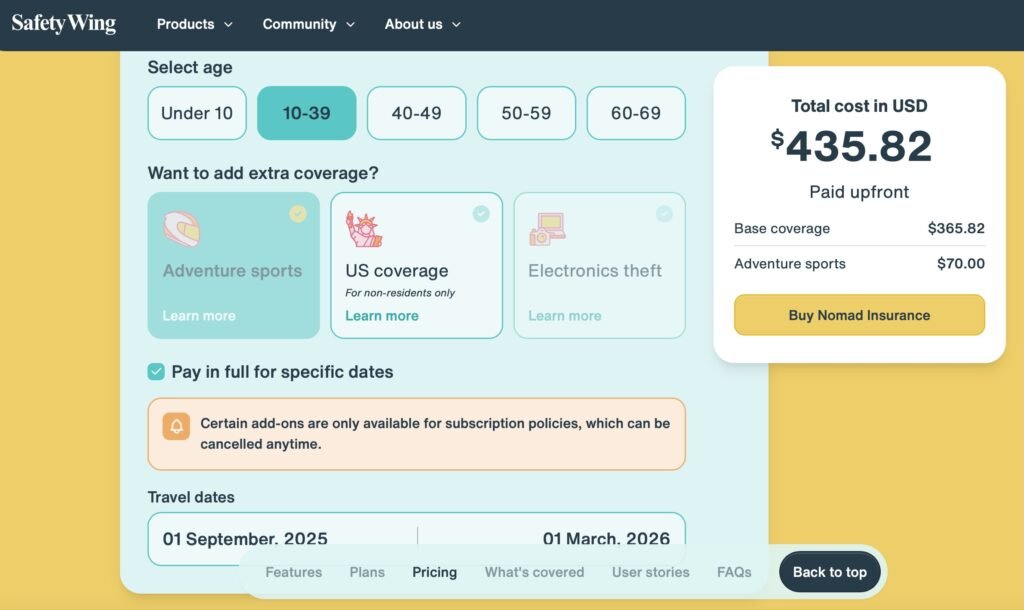

Safetywing

With Safetywing Dave chose the Nomad Essential plan with the addition of their Adventure Sports add on. The total cost of his insurance for his 6 months came to $435.82, which is $2.40 per day. As he is price conscious, he decided to pay in full upfront for his specific travel dates, to save more money. Had he not done this, and instead opted for the rolling 4 weekly cover that is typical for this policy, the price would have been a little more expensive, at $463.96.

World Nomads

Things were looking pretty good for Dave with World Nomads, until he input his planned skydive, bungee jump and shark caging into the World Nomads quote. This added a whopping £900 to his insurance total, to bring the final amount to £1349.57. He did, however, appreciate knowing that all of his planned activities would be covered, having individually selected and added them to his policy, rather than having to scroll through policy documents to check manually.

Heymondo

After browsing the Heymondo site, Dave opted for their ‘Long Stay Insurance‘. He initially input his data into their ‘International Travel Insurance’ plan, but fortunately then also decided to try their long stay policy which came out significantly cheaper.

Even with the addition of Adventure Sports cover for his planned activities, Heymondo’s Long Stay Insurance came to a total of 363.49 EUR. This is made up of a base 179.49 for the first 90 days, and an additional 120 days renewal price of 184. Dave particularly liked the ability to pay in two installments that would cover the entire duration of this trip, rather than having to pay it all upfront, as he’s still waiting til the end of the month to get paid.

GENKI

For Dave, the best option with Genki is their ‘Traveler’ policy, as it comes in considerably cheaper than their premium ‘Native’ policy.

Dave would be covered for all sports & activities apart from alligator wrestling, BASE jumping, bull riding, hunting, running of the bulls, train surfing, and wingsuit flying. So he can really let loose with Genki as they’re pretty laissez-faire when it comes to adventure sports coverage!

The total price for Dave with Genki Traveler comes to 315 EUR for his 6-month backpacking adventure, which came out the cheapest of all four insurance providers! As he pays 52.50 EUR each month on a subscription, Dave also has the flexibility to cancel his policy after the first month at any time, just in case he’s forced to cut short his trip for any reason.

On this policy, he pays a €50 deductible on any claim made.

Adventure Sports Cover at a reasonable price winner is Heymondo!

This was close one between Heymondo and Genki, with Genki Traveler coming out as the cheapest option for Dave. However, for a just bucks more, the Heymondo policy, which included the adventure sports addon, also offered personal belongings coverage and trip cancellation etc. That's what clinched it.

If you're Dave, or you know one, and this sounds good to you, get a quote yourself and as a Travel Tortoise reader you'll get an additional 5% discount on the cost of your policy!

TEST #2: COMPARING ELECTRONICS PROTECTION

Quick recap on the Griswald’s insurance needs: Our family of four from the USA are traveling to Italy for a two week vacation. They’re bringing laptops, the latest iPhones, and a couple of very expensive SLR cameras. Their teenage kids Rusty and Audrey are both known for being particularly careless with their stuff. Anyone who has traveled abroad with kids will understand their needs.

Must haves: comprehensive electronics protection. Ideally: high level medical coverage too…

- Safetywing

- World Nomads

- Heymondo

- Genki

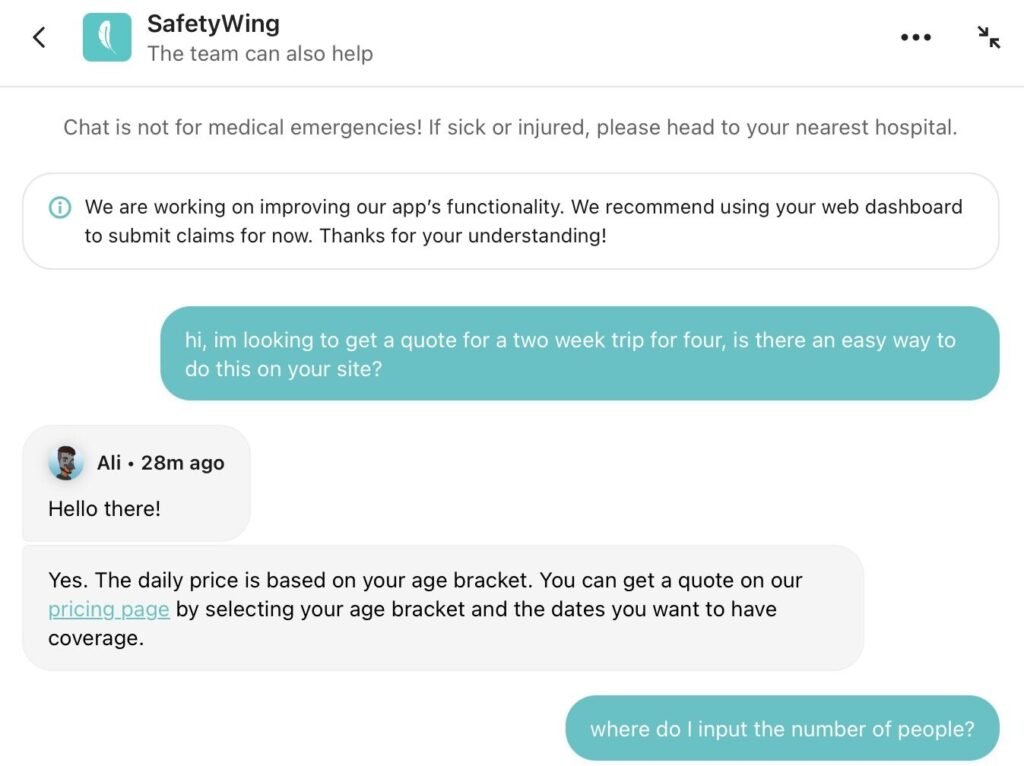

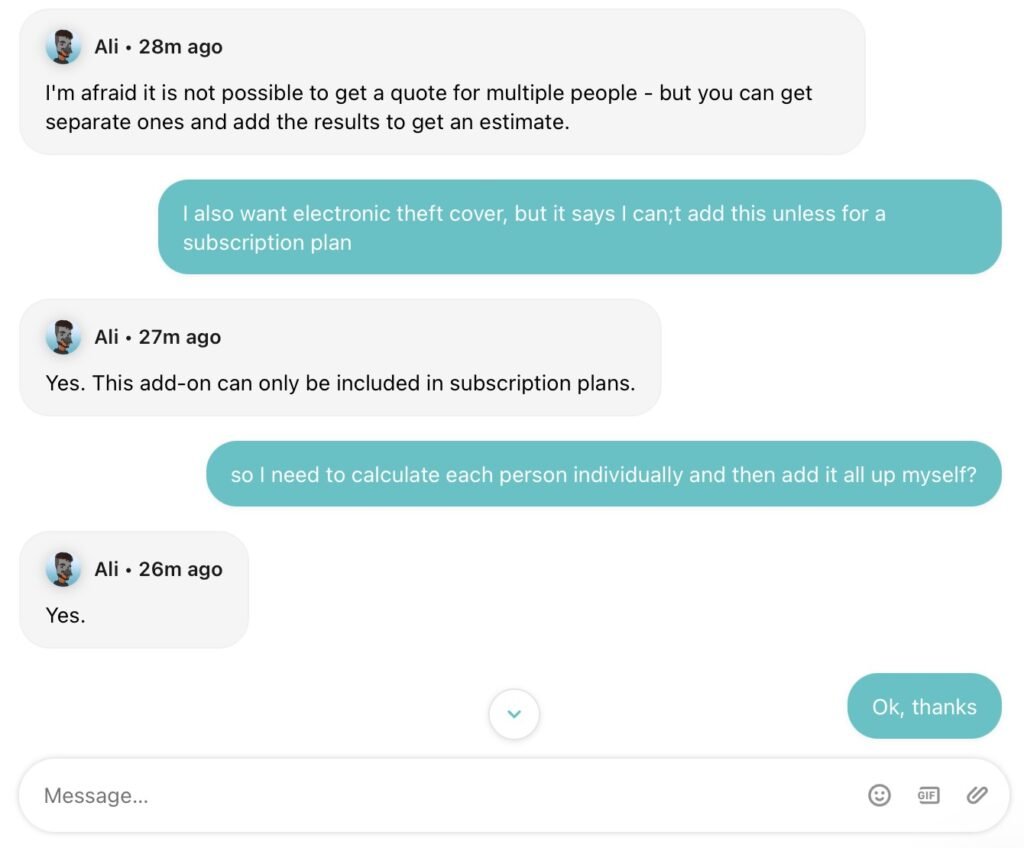

Gotta admit here that Safetywing was bit of a pain to even get a price for the intrepid Griswolds. They don’t have an option for group pricing, so I had to manually calculate the price for four based on their individual pricing for each age bracket.

Furthermore, I was unable to add on the extra theft protection for electronics when inputting the exact dates for their 14 day trip in August. I had to calculate four separate 4 week periods of cover (two for Mom and Dad in the 40-49 category, and two for the teenage kids in the 10-39 age bracket).

The total came to $337.36 for their two week trip to Italy. This seemed a bit like overkill, as they were left with a far longer period of cover than needed. Additionally, their electronics theft covers only that – theft, while loss and damage appears not to be covered, even with the addon.

The entire process (including the chat I had with their support staff) also took a while, so I reckon Safetywing really need to improve this user experience, as it may put all but individual travelers off once they realise how challenging it is to get a group price! Had I not persisted for the sake of conducting this research, I would have given up much earlier.

The best offer from World Nomads was on their Standard plan, which comes to $381.67 in total. This provides cover for damaged, lost, stolen or destroyed baggage or personal belongings up to $1000 per person, with a per article limit of $500. This might not cut it considering the Griswold’s penchant for expensive gadgets and electronics, so the next cheapest policy is called Explorer and costs $735.42. This provides cover of up to $2000 per person, with a $1000 per article limit.

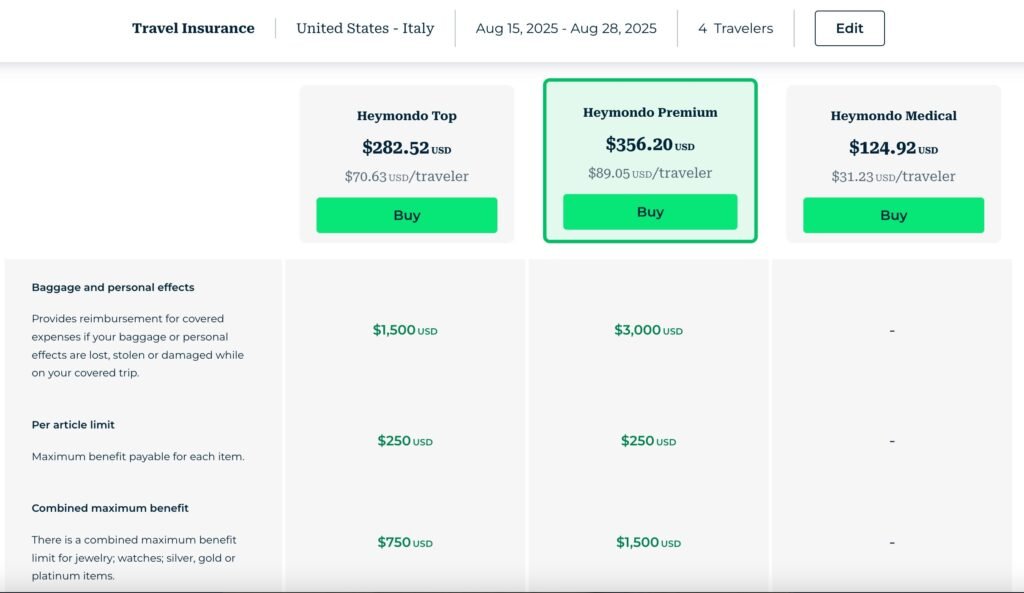

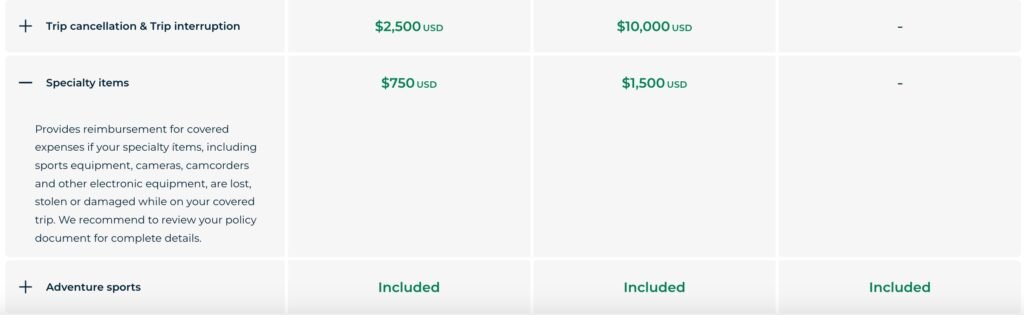

Heymondo was relatively straightforward here. Inputting the details for the Griswold family automatically transferred me to their US based site, and from there I had quote within 30 seconds on their ‘Single Trip Insurance‘ page. I just had to input the destination, dates and number of travellers. I was provided with three different insurance options, their Top, Premium and Medical plans, and judging on the levels of cover, for our family of four the best option with Heymondo is their Premium plan. This came to a total of $356.20, full details of the baggage and personal effects cover for loss, theft or damage below.

As Genki don’t offer any policy that meets the needs of the Griswolds and their extravagent gadgets, they were simply not an option to consider.

Electronics cover at a reasonable price winner is World Nomads!

While Heymondo's policy was considerably cheaper than World Nomads, the low ($250) per article limit for personal belonging and baggage just didn't cut it for Clark, and the rest of the Griswolds. If you can afford it the Explorer policy from World Nomads was clearly the best, with a $1000 per article limit. Both Safetywing and Genki focus more on Travel Medical Cover rather than other travel related expenses, and this was clearly on show in this comparison. Get a quote with World Nomads here...

TEST #3: COMPARING LONG-STAY INSURANCE COVERAGE

Quick recap on Pam & Barry’s insurance needs: despite rejecting the title of ‘digital nomads’ Pam & Barry are clearly planning to be a long-term international remote workers!

Must haves: USA coverage. Ideally: no coverage restrictions when back in Oz to visit family…

- Safetywing

- World Nomads

- Heymondo

- Genki

When inputting exact departure and return dates for their 12 month trip, Safetywing returned a per person price of $1357.72, including a US coverage addon. It was very fast and easy to get this price from their website.

What I liked most about this policy is if Pam and Baz return to their home country, they’ll also retain medical coverage there for stays of up to 30 days at a time.

They also have the option to not fix their dates, by just renewing with Safetywing on a 4 weekly basis. Therefore, assuming they still had home country coverage, each time they went back home they’d be able to pause their cover, which obviously gives them the ability to reduce costs even further.

World Nomads were super expensive at $4,477.42 AUD for Barry and Pam’s trip. It wasn’t possible to differentiate on their site between several trips within a 12 month period, and the only option I had to input the details was giving a single trip duration of a year into their system.

Heymondo returned a price of $2,462.27 for a 12 month continuous trip. While this is considerably more expensive than Safetywing, this policy (Heymondo TOP) did include more comprehensive cover for things like lost/stolen baggage, travel disruption, and trip cancellation.

If Pam and Barry are planning to make multiple trips instead of one single 12 month trip, then Heymondo’s annual multi-trip insurance came out at just $511.10 for both! However, each trip on this policy can be no longer than 60 days long, and there is also a medical deductible which is payable for any treatment received. Furthermore they would not be covered on any return trips back to their home country. As both have quit their jobs to become digital nomads, they have no medical cover back home anymore, so this is not ideal for them.

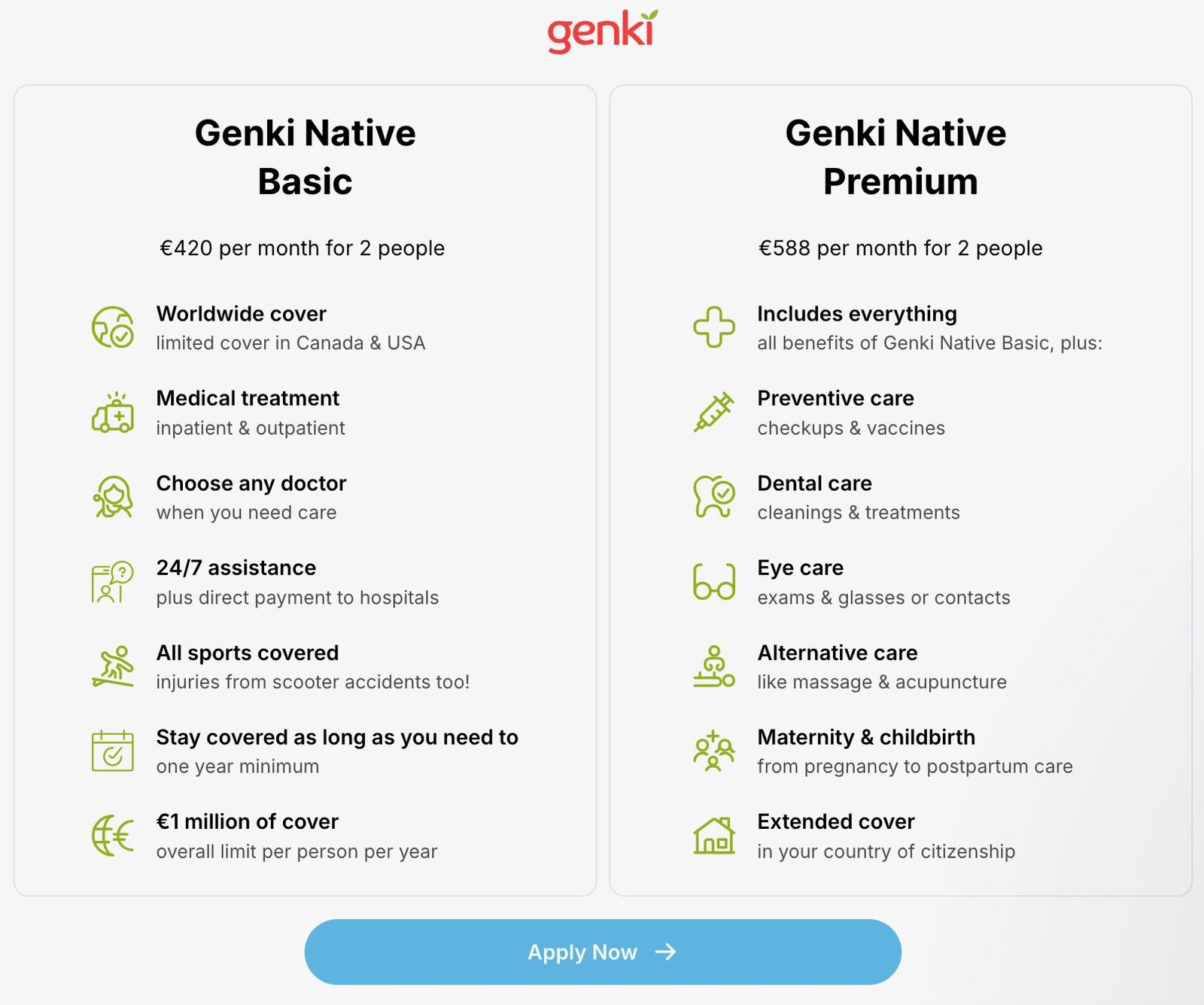

Genki returned two different prices. Its Genki Native Basic policy came in at 420 EUR per month for both of them (including 182 days of cover back home), while Genki Native Premium, which also includes maternity, dental, and preventative care, as well as full cover back home in Australia for them, came to 588 EUR per month.

Both policies offer 182 days of coverage in the USA and Canada.

Looking at both policies, and considering that our intrepid couple plan to both be working while away, Genki Native Premium seems to be the best policy for them, as it allows total freedom to return home, and spend as much time as they want in North America.

Admittedly, Genki Native Premium is an expensive option, but of all the policies that I looked at, the level of cover provides the most security for Pam and Barry.

Long-stay cover at a reasonable price winner is Safetywing!

While Heymondo's annual multi-trip insurance provides a good level of cover, the added piece of mind of being covered back home while visiting family and friends is what makes Safetywing the winner in this long-stay insurance category.

COMPARING WEBSITE USER EXPERIENCE

In researching and writing this article, and over the years of searching for and using travel insurance for myself, what I’ve come to appreciate most is user experience. What I find important is how quick and easy it is to get quotes and information specific to your planned trip. It shouldn’t be hard to find a price for your number of travelers, trip duration, and destination!

Equally, ploughing though painfully boring and often confusing insurance policy documents isn’t sexy, nor is it gonna get you pumped for your upcoming trip, so the more details a website gives on what’s covered and what’s not can make all the difference.

This is especially important as many people might be using a website’s booking pages as their only frame of reference for their coverage. Indeed, when it comes to buying travel insurance, most people have found to barely even skim read their policies.

That’s actually what I really liked about Safetywing. While I had my issues with their individual pricing model (no, YOU do the math!), I did rather like the overall simplicity of their plans, and the repeat messaging found all over their website. With either the Nomad Essential or the Nomad Complete coverage to choose from, Safetywing made it pretty clear exactly what was included in my policy.

Also, I contacted the help departments for all companies at the quote stage, and only Safetywing and Genki (via Whatsapp) had a human-led live chat function, which meant I got my answers almost immediately. Heymondo and World Nomads were more AI-bot led, so I suspect that they will lose a fair few customers due to that.

HEYMONDO VS GENKI VS SAFETYWING VS WORLD NOMADS: FINAL THOUGHTS

There is much to like about all of the travel insurance companies that I put to the test here. World Nomads, while very expensive pretty much across the board, do offer high levels of medical and electronics cover, as well as the most comprehensive protection for adventure sports buffs. What baffles me about them though, is that their most likely core market (i.e backpackers and younger travelers in the 18-35 age range) are probably the least likely to be able to afford their coverage.

Safetywing are clearly a great choice for anyone planning to go abroad for longer stays. If you are among the ever-increasing global community of digital nomads, they should be your first port of call when it comes to travel insurance. I also like their overall philosophy, which seeks to democratize global health insurance by promoting true freedom of movement between nations.

It’s also clear that with their Nomad Complete policy which includes maternity care, ongoing coverage for new conditions, mental health care, and no coverage restrictions at all while back in your home country, they are absolutely committed to improving the feasibility of global remote working for digital nomads.

The same can be said of Genki in fact, especially their Genki Native coverage. It enables long-term travelers to have genuine peace of mind that all their needs will be covered, albeit at a pretty hefty price tag in some cases.

Heymondo turned out to be a very pleasant surprise indeed. I had no prior experience with them before researching for this article, but in each of my test scenarios they returned some very competitive pricing. What’s more, for all non-US based readers of the Travel Tortoise, if you click through to them using our links you’ll get an additional 5% discount off the cost your insurance!

I was also really impressed with how intuitive and simple-to-use their website is. They are also known for having top notch tech to accompany their policies, with easy claims management and a 24hr medical chat function available in their app. One area of improvement though would be having a human live chat function at the quoting stage though. Overall though, my Heymondo travel insurance reviews are very positive, with fair pricing and comprehensive policy options for single trips, annual trips and long-stays.

This was a fantastic deep dive—super useful, especially for those of us who aren’t insurance-savvy! I really appreciated the real-world comparisons like Dave’s shark cage antics and the Griswalds’ electronics dilemma. It’s refreshing to see someone break down something as dull as travel insurance in such an engaging and relatable way. Definitely bookmarking this before my next trip!

Thanks very much for the lovely feedback – I’m glad it helped you!