If you’re based in the UK, you’ll already know that there are loads of companies, meerkats and even opera singers trying to persuade you that their travel insurance is the best fit for your needs. But rather than trudging through reams of marketing material about levels of cover, what’s included and what’s not before even getting a quote, sometimes you just want a brief overview of the main strengths of each company, and then go from there. So how about hearing it from a tortoise real travel expert instead?!

I’ve taken a good look at five popular UK travel insurance providers and compared InsureandGo vs Staysure vs Oasis Insurance vs Cedar Tree vs Holiday Extras! Each one has developed core strengths which will appeal to different types of travellers – whether you’re an adrenaline junkie, managing existing medical conditions, travelling frequently, or just looking for simple, cheap family cover with a few extras thrown in.

Alright, let’s dive in…

THE TOP 5 UK TRAVEL INSURANCE COMPANIES

SHORT ON TIME?

InsureandGo a great all-rounder, offering good value and broad cover for both single and annual multi-trip policies, with a big range of potential addons for whatever you’re into.

Oasis especially good for backpackers, and those with pre-existing medical conditions. Offers clear policy boundaries and control over what’s included.

Staysure remains the standout for anyone with pre-existing conditions as well as older people who still want to travel confidently with high levels of medical cover.

Cedar Tree suits frequent flyers and business travellers, and those who need comprehensive activities and adventure sports coverage. Use code ‘CEDARTREE5‘ for a 5% discount at checkout too!

Holiday Extras is best for families or budget-conscious travellers who want simple, no-fuss protection alongside airport parking or other extras.

The Contenders

Before going into more depth into who each company is best suited for, it’s important to also consider how long they’ve been around for and who underwrites their policies. The underwriter is the large insurance company that ultimately carries the financial risk and pays claims, so knowing the underwriter gives you confidence in the policy’s backing. Here’s a brief introduction to each of our contenders…

InsureandGo

Founded back in the year 2000 and underwritten by Zurich, InsureandGo offer good value insurance packages and addons, ideal for families and active holidaymakers, with a huge list of included activities on its policies.

Staysure

Established in 2004 and backed by the Munich RE group, Staysure specialise in insurance for people with pre-existing medical conditions, and as such are popular among older travellers. Features include no upper age limits and particularly high levels of cover.

Oasis

Underwritten by Great Lakes Insurance group, Oasis have been around since 2020. Great for backpackers, older travellers and those with pre-existing medical conditions, thanks to its inclusive approach and clear, easy-to-understand tiers.

Cedar Tree

Established in 2017, and underwritten mostly by the AXA group (depending on which policy is chosen), Cedar Tree are particularly strong for frequent (or business) travellers who need annual multi-trip cover, and extensive adventure sports coverage.

Holiday Extras

Also underwritten by the Great Lakes group, Holiday Extras was founded in 1983, originally to provide affordable airport parking. Over time the business expanded into airport hotels, lounges, and eventually travel insurance.

WHAT EACH TRAVEL INSURANCE COMPANY IS BEST FOR?

INSUREANDGO — Best For Active Holidays and a great all-rounder

Best for: Anyone planning an activity-filled break, as well as those looking to tailor their insurance policies to specific needs. Older travellers can also find value here, with pretty much every pre-existing condition considered.

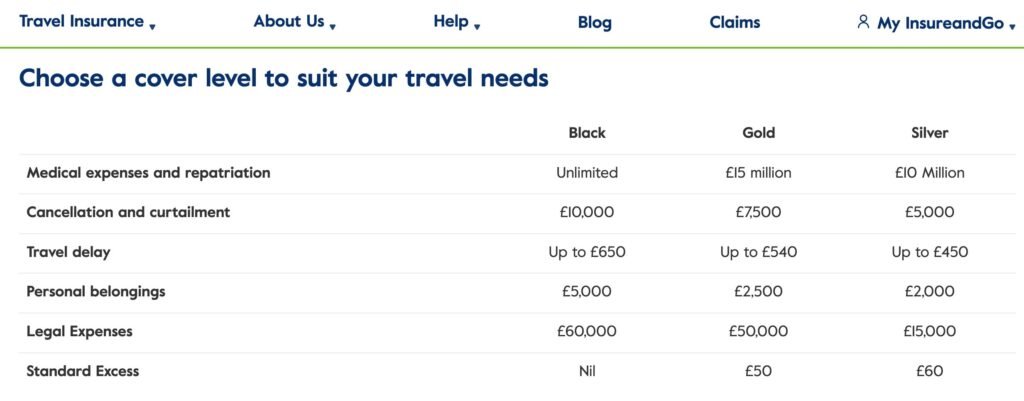

InsureandGo offers three levels of cover, from the more budget ‘Silver’ policy, through ‘Gold’ up until ‘Black’ – their premium product. The Black tier even includes unlimited cover for emergency medical treatment and repatriation.

They offer tailored policies for extreme sports, golf, winter sports, and scuba diving enthusiasts. Additionally, over 100 activities are automatically included, including surfing. bungee jumping and horse riding, which is pretty generous compared with other policies out there.

With no upper age limit, InsureandGo are also a viable option for older travellers and those with pre-existing medical conditions – these must, however, be declared and applicants will be subject to InsureandGo’s medical screening process.

Get a quote now for single or multi-trip travel insurance

Tailor your cover and explore InsureandGo's numerous addons with either a Black, Gold or Silver policy.

OASIS — Best For Backpackers & Medical Peace of Mind

Ideal for travellers with medical conditions & older customers, backpackers, and families who want easy-to-understand policy tiers.

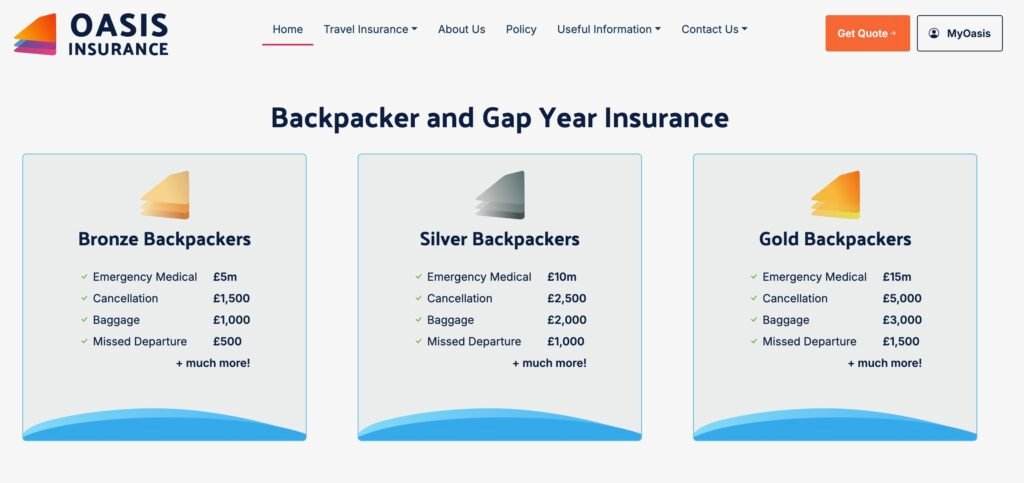

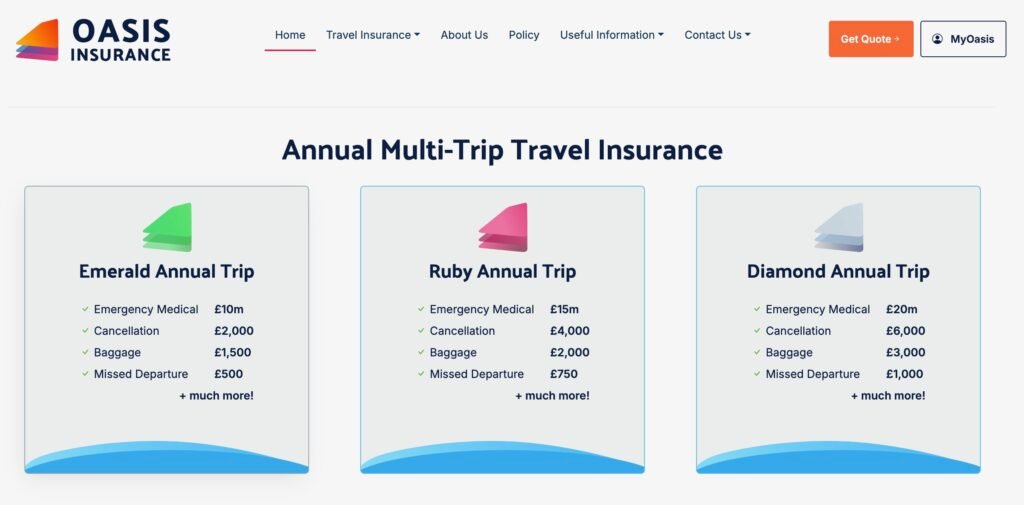

Oasis (the insurance company – not Noel & Liam) offer three tiered products – namely Emerald, Ruby, and Diamond. Each tier has set levels of medical and cancellation cover, so you can see exactly what you’re getting quickly and clearly. Furthermore, they also offer three tiers of backpackers coverage, from bronze up to gold.

The standout feature is how they handle pre-existing conditions. Oasis is open to covering many medical conditions and does not impose strict upper age limits on many single-trip policies. This makes them a top pick for older travellers or those who need medical peace of mind.

Clear and easy to understand tiers

No upper age limits and specialist backpackers travel insurance

Check out Oasis' three tiers of Backpacker's insurance, as well as their standard Emerald, Ruby and Diamond policies for all other types of traveller.

CEDAR TREE — Best For Annual Multi-trip Cover & Adrenaline Junkies

Ideal for frequent travellers, business travellers, and those who enjoy active holidays, with extras like cruise or golf cover.

Cedar Tree has built a reputation for its annual multi-trip cover. Many policies consistently include £15m of medical cover, which is reassuring for frequent travellers who want reliable protection on every trip. Along with InsureandGo they also have the most comprehensive list of adventure sports and activities covered as standard.

And if your particular activity is not included, what also sets them apart is their choice of add-ons, with cover to include cruises, golf, and winter sports, so whether you’re Jane McDonald, Nick Faldo or Eddie the Eagle Edwards, you’re sorted with Cedar Tree!

To be eligible for their coverage you must be a UK resident, and your trip(s) must start from and end in the UK. Cedar Tree have no age limits for their single-trip insurance policies, but for their annual multi-trip policies the maximum age is 66 years old.

Get covered for your active holiday with an extra 5% off your policy!

Make sure your 30m scuba dive and bungee jump is covered with Cedar Tree Insurance, and use the coupon code 'CEDARTREE5' for a discount on the cost of your policy.

STAYSURE — Best For Over-50s

Best for: Travellers over 50, retirees, and anyone with medical conditions needing reliable cover.

Staysure is one of the UK’s most recognised travel insurers, particularly for those over 50. Crucially, they impose no upper age limits on both their single trip and annual policies. They specialise in covering pre-existing medical conditions and they offer a selection of optional extras like cruise, gadget, golf, and winter sports cover, as well as excess waiver and travel disruption.

All the above makes Staysure especially attractive to retirees and older travellers who want to travel with confidence and peace of mind, without necessarily going round the houses just to be considered and get a price!

Get cover for your pre-exisiting medical conditions

Travel with piece of mind, knowing that your pre-existing medical conditions are covered with Staysure.

HOLIDAY EXTRAS — Best For Budget & Convenience

Ideal for travellers who want affordable, straightforward cover, and those who need airport parking or lounge access too.

Holiday Extras is primarily known for its airport parking, lounges, and transfer services, but it also offers straightforward travel insurance. The focus is on simplicity and value, with single-trip and annual cover available. Policies usually include essentials like medical and cancellation, with optional extras for winter sports.

Because Holiday Extras already has a big footprint in the “extras” space, what you get by booking with them is almost like a ‘travel one stop shop’ and good old fashioned convenience to do everything at the same time. While their cover levels may not reach the same heights as Cedar Tree or InsureandGo, the appeal here is in simplicity and bundling.

THE BEST INSURANCE FOR FAMILY TRAVEL

| Provider | Best For | Family Perks | Quick Verdict |

|---|---|---|---|

| InsureandGo | Budget-savvy families | ✅ Free cover to children under the age of 12 | Best on a budget |

| StaySure | Families with medical needs or older relatives | ✅ Covers 500+ conditions ✅ High medical limits | Best for peace of mind |

| Cedar Tree | Active families & teenagers | ✅ 100+ adventure activities ✅ Solid gadget cover | Best for sporty trips |

| Holiday Extras | Most families, all-round value | ✅ Easy add-ons ✅ Great support | Best for busy parents |

| Oasis | Families who like control | ✅ Customisable cover ✅ Clear policy wording | Good for careful planners |

💡 Tip: If you travel more than twice a year, an annual multi-trip policy often works out cheaper than multiple single-trip ones — especially with free child cover.

CUSTOMER EXPERIENCE AND CLAIMS

As expected, all five insurers have mixed online reviews, which is pretty normal for travel insurance companies, although all are among the highest rated providers on Trust Pilot.

At the time of writing, leading the pack is InsureandGo UK, with a 4.8 customer rating from over 110,000 reviews. Oasis also have a 4.8 rating from over 6000 customer reviews, while Staysure come in at 4.7 from almost half a million reviews. Cedar Tree have a 4.6 rating from over 6000 reviews, and Holiday Extras come in at 4.4 from almost 50,000 independent customer reviews.

The most important thing is to check the official documents (the IPID or full policy wording) for exact cover limits though, as most bad reviews emanate from people’s unrealistic expectations of what was and what wasn’t actually covered in their policies. Reading the entire policy, and fully understanding what is and isn’t covered by it makes all the difference.

THINGS TO KNOW BEFORE BUYING TRAVEL INSURANCE

- When getting a quote, be sure to declare all pre-existing conditions – if in doubt, phone the company directly to see if it’s covered.

- Check the medical and trip cancellation limits in the table of benefits to ensure you’re happy with them. It sucks having a £2500 SLR camera stolen and later realising you’ll be compensated just £50 quid for it.

- Make sure that whatever activities you’re planning to do (skiing, diving, hiking, rally driving, shark diving, Felix Baumgartner’ing etc.) are covered in your policy!

- Understand whether or not you’ll have to pay an excess or not, and consider paying a little extra at the outset to remove it.

- Once you’ve decided on a company and a policy, save their emergency helpline number on your blower.

- Store (and actually read!) your IPID (Insurance Product Information Document) or full policy document somewhere safe before you leave.

- And, if things do go tits up on holiday, be sure to keep all receipts and medical paperwork for any future claims.

BUYING TRAVEL INSURANCE FAQ

If you travel more than once or twice a year, annual multi-trip insurance is usually cheaper than buying separate single-trip policies, yes.

Yes, but insurers may require additional information, medical questionnaires, or premium adjustments. Always declare all conditions honestly when getting a quote, as failure to declare can invalidate your cover!

Known for accommodating multiple conditions, StaySure, InsureandGo, and Oasis are particularly reliable options for travellers with pre-existing conditions, though, again, you must declare them when getting a quote. As coverage can vary by condition between different providers, always check the insurer’s exact policy wording.

Not all. Many policies cover cancellations if the traveller or close family member becomes ill, but coverage can vary based on whether conditions are pre-existing or not. You’re gonna have to get down and dirty with the small print again here!

Most do, to a certain extent at least. However, both InsureandGo and Cedar Tree are particularly strong in covering adventure sports in their regular policies, and for anything else more extreme there are optional add-ons. Check each insurer’s activity list before booking.

Yes. Some insurers cover these activities only to a certain depth (e.g., scuba 30m) or altitude, or require an “adventure/hazardous activities” add-on. Hate to sound like a broken record here but always confirm the activity limits in the policy wording!

Refer to our table above for full details on how each of these UK travel insurance companies will mostly likely suit different families.

UK TRAVEL INSURANCE: THE FINAL WORD

The main benefit of having good travel insurance is the ability to switch off the admin brain, go enjoy your trip, and let the insurance do what it’s supposed to do: stay quietly in the background while you have a great time. The trick is matching the policy to the kind of traveller you really are though. Read the small print, check precisely what is and isn’t included, and buy the cover that matches your actual plans.

At the end of the day, the best policy isn’t necessarily the cheapest – it’s the one that won’t leave you stranded arguing about what counts as “mild rock climbing” 🙂 But between these five, most UK travellers will find an option that fits, and if not then also consider checking out my post comparing Heymondo with Safetywing and World Nomads.

Leave a reply